Thailand is positioning itself for the next wave of economic growth by harnessing opportunities in innovative, high-potential sectors. While manufacturing remains a cornerstone of the economy, the country is increasingly shifting its focus toward areas such as data centers, artificial intelligence, electric vehicles, precision agriculture and food technology. This strategic pivot is vital to enhancing Thailand’s global competitiveness amid evolving global dynamics.

The Thai economy is projected to expand by 2.3% in 2025, with export growth supporting manufacturing and related service sectors in the first half of the year. Thailand continues to draw strong foreign investment, reflecting investor confidence in its robust infrastructure, integrated supply chains, skilled workforce, regional connectivity and pro-business policies. In the first half of 2025, foreign investment reached approximately 111.5 billion baht (US$3.5 billion), a 30% increase compared to the same period in 2024. Of that amount, 56% was directed to the Eastern Economic Corridor (EEC). These investments spanned a range of sectors, including retail trade, R&D services for engineering plastics, data center services, digital platform development and contract manufacturing.

Shift to a Low-Carbon Future

A central part of Thailand’s industrial reform lies in its push toward a green and circular economy. The country is committed to transitioning toward a low-carbon future, aiming to achieve carbon neutrality by 2050 and net zero emissions by 2065.

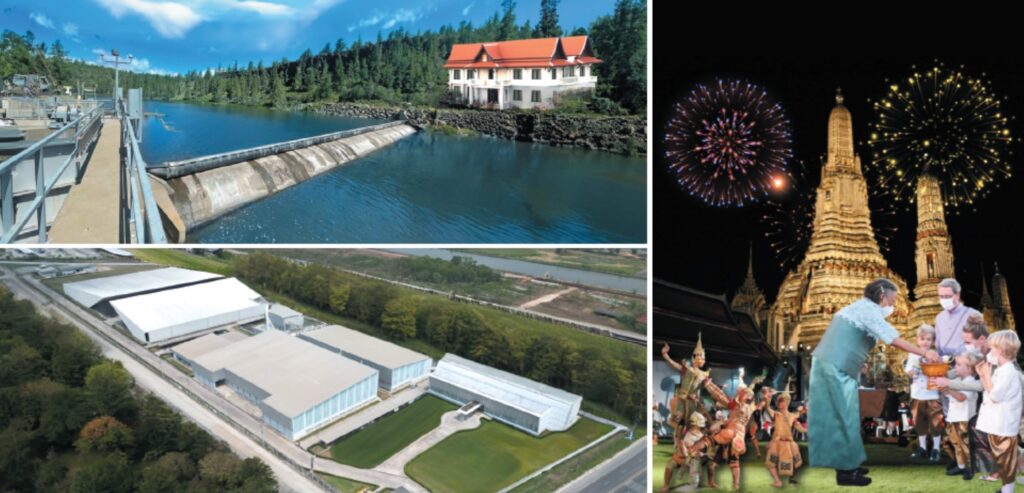

B.GRIMM, one of Thailand’s largest private energy producers, plays a key role in the nation’s energy transition and pursuit of net zero goal. More than a business, B.GRIMM has contributed to Thailand’s technological, scientific, cultural and social advancement. At the hear t of B.GRIMM’s operations is its vision of “Empowering the World Compassionately,” reflecting an ethos that business can thrive in harmony with nature and community. This philosophy underpins the company’s GreenLeap – Global and Green strategy which drives sustainable growth guided by four core values: positivity, partnership, professionalism and pioneering spirit.

Another leading Thai conglomerate, Siam Cement Group (SCG), is also contributing to a low-carbon future through its innovations. In 2023, SCG introduced Thailand’s first certified low-carbon cement. Together with coordinated policies, the company believes that its broader adoption can accelerate decarbonization in construction and unlock socio-economic value, not just in Thailand but also in developing countries. SCG also invests in R&D to develop other solutions such as green polymers and recyclable packaging that help reduce environmental impact across industries.

Real Estate Recovery

Meanwhile, the real estate sector, one of the key drivers of the Thai economy, is showing signs of recovery. Investments in the EEC are creating spillover effects, driving residential demand alongside industrial growth. Luxury developments and branded residences in Bangkok and beyond continue to attract interest from both local and international buyers.

SC Asset’s latest development, SONLE Residences, located on a rare freehold plot in Bangkok’s Ratchadaphisek area, reflects the demand in the ultra-luxury market. Comprising five exclusive homes, SONLE Residences is a manifestation of SC Asset’s long-term vision. These homes are designed with intentionality, sustainability and craftsmanship, and are meant to serve as lasting legacies for their owners. In a market of ten marked with uncertainty, SONLE Residences embodies prudent assurance, offering clarity, permanence and a home that reflects thoughtful living beyond wealth.

With market watchers optimistic about the real estate outlook, the sector is expected to support economic growth as Thailand continues to pursue opportunities amid global uncertainty and domestic challenges. By embracing innovation and investing in future-ready industries, the country is charting a path toward long-term growth.