As Singapore marks its diamond jubilee this year, the city-state stands at a pivotal juncture—reflecting on a remarkable nation-building journey while charting a course forward amid prevailing global uncertainty.

Singapore’s economy continued to grow in the second quarter of 2025, expanding 4.4% year-on-year despite persistent external challenges. This better-than-expected performance, following 4.1% growth in the previous quarter, was driven primarily by the wholesale trade, manufacturing, finance and insurance, and transportation and storage sectors.

Taking into account the positive performance of the first half of the year, the Ministry of Trade and Industry has upgraded Singapore’s GDP for the year to 1.5% to 2.5%.

Empowering a Future Workforce

As Singapore seeks to maintain its competitive edge, human capital remains its strategic advantage. With AI and advanced technology reshaping the workforce, the nation is investing heavily in job transformation and creation as part of its economic strategy, ensuring that its workforce is engaged in lifelong learning and upskilling. Businesses are encouraged to adopt a skills-first approach to hiring and development, with the ability to reskill, redeploy and redesign roles quickly.

Workforce Singapore (WSG) plays a leading role in helping employers plan and execute their job transformation strategy. Companies can tap into WSG’s job redesign initiatives and reskilling programs to redesign roles and processes, expand their talent pool and reskill their workers to enable more effective integration of both talent and technology. Initiatives such as the Career Conversion Programmes support firms in reskilling employees for evolving job scopes. Funding and advisory services further provide companies with a comprehensive pathway to workforce transformation. This structured approach ensures a future-ready workforce.

A Vibrant Tech Hub

Singapore has established itself as a strong tech hub, attracting both startups and multinational corporations that are seeking to leverage the city-state’s thriving ecosystem of innovation and access to regional markets.

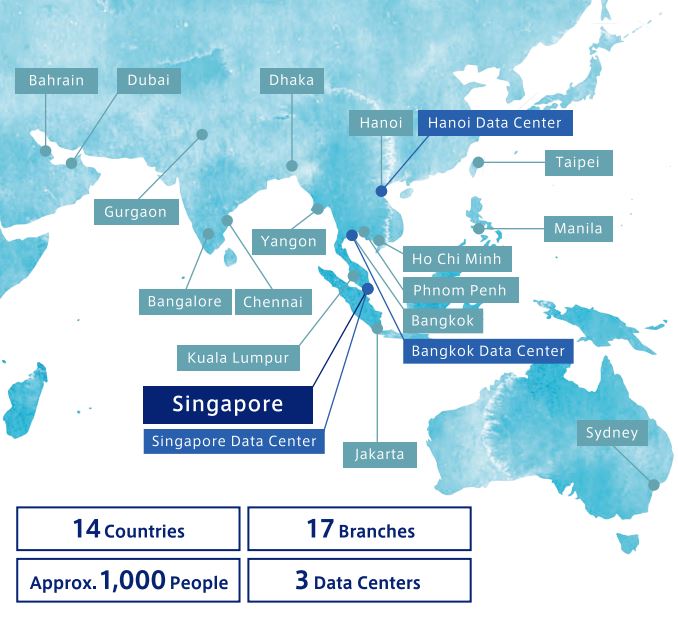

KDDI Asia Pacific (KDDI APAC), the regional arm of Japan’s KDDI Corporation, is one such multinational that has set up its headquarters in Singapore. One of Japan’s largest telecommunications companies, KDDI APAC delivers integrated cloud, cybersecurity and managed IT services.

The Singapore office plays a central role in KDDI’s ability to deliver its solutions at scale across the region. Singapore, serving as its technological and economic engine, presents KDDI APAC with a pivotal opportunity to be a cornerstone not only for the region but also for its entire global strategy, including Japan.

Recognized as a Global Financial Center

A global financial center, Singapore serves as a key node for Southeast Asia and beyond, supported by a robust regulatory framework that balances innovation with risk management. In 2024, the financial services sector accounted for about 14% of Singapore’s GDP. The sector grew by 6.8%, more than double the growth rate of the preceding year. Singapore’s assets under management surpassed S$6 trillion (US$4.675 trillion) in 2024, a significant milestone driven by strong performances in private equity, venture capital, hedge funds, real estate and real estate investment trusts.

Singapore has strengthened its position as a leading wealth management hub, recognized for its strong governance, pro-business policies and political stability. It continues to attract high net worth (HNW) individuals and families seeking a range of services—from investment management and succession planning to risk and insurance planning, family office setup and private banking.

Standard Chartered Global Private Bank has seen growing demand in the region for holistic legacy planning. The bank works with ultra-high net worth individuals and families beyond formal planning sessions, offering ongoing support that extends outside traditional wealth and legacy discussions.

AIA Singapore is also helping wealthy families and individuals navigate complex legacy planning through its integrated ‘Wealthbeing by AIA’ proposition. In 2024, AIA Singapore launched AIA International Wealth (IW) and AIA Wealth Centre, two major initiatives under its broader ‘Wealthbeing by AIA’ proposition. These pillars are part of a bold, multi-million-dollar strategy to redefine legacy planning for Asia’s affluent families and elevate AIA’s standing as the region’s insurer of choice.

Meanwhile, Royal Bank of Canada (RBC), which has operated out of Singapore for 50 years, is building deeper capabilities to help clients in Asia navigate an increasingly complex global landscape. The bank’s Asia platform is anchored by two core businesses: capital markets and wealth management. The bank’s decision to base these operations in Singapore reflects the country’s strong regulatory environment, skilled workforce and connectivity to the rest of the region. RBC is working to deliver cohesive solutions, particularly for HNW clients whose needs span jurisdictions and asset classes.

Demand in Premium Real Estate

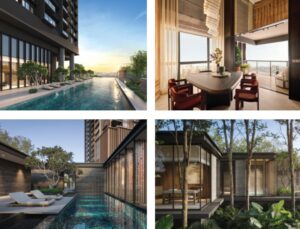

Singapore’s real estate market continues to attract strong demand from HNW buyers, driving a steady pipeline of luxury and ultra-luxury developments. These investors seek homes with prestigious addresses, spacious layouts and premium designer finishes—whether for investment or as trophy residences.

UOL Group Limited’s (UOL) UPPERHOUSE at Orchard Boulevard achieved a 54% take-up rate on launch day. The 99-year leasehold development, a joint venture with Singapore Land Group, offers 301 one- to four-bedroom units in Singapore’s prime District 10.

UPPERHOUSE at Orchard Boulevard reflects UOL’s broader strategy to invest in and elevate the Orchard Road precinct. The company has a long-established presence in the area, and recent developments signal its commitment to enhancing the area’s appeal as both a lifestyle and residential destination.

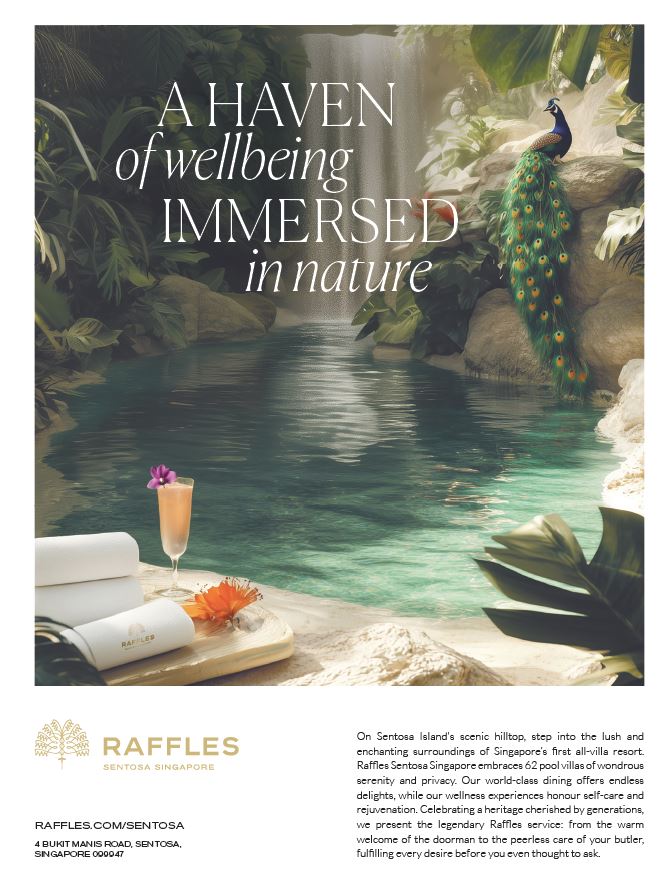

Extending the luxury experience into the hospitality sector is Raffles Sentosa Singapore, the city-state’s first all-villa resort, developed and owned by Royal Group. Located just 10 minutes from the central business district, the resort features 62 private villas—each with its own pool and dedicated Raffles butler—offering a new benchmark in exclusivity and service.

Beyond SG60

As Singapore charts its path forward, it must navigate an increasingly complex and competitive global landscape. To remain resilient and relevant, a renewed economic roadmap is essential.

Through the Economic Strategy Review, the government is re-examining national priorities across five critical areas: competitiveness, technology, entrepreneurship, human capital and economic restructuring. The new roadmap aims to position Singapore for sustainable growth and build a future-ready economy.